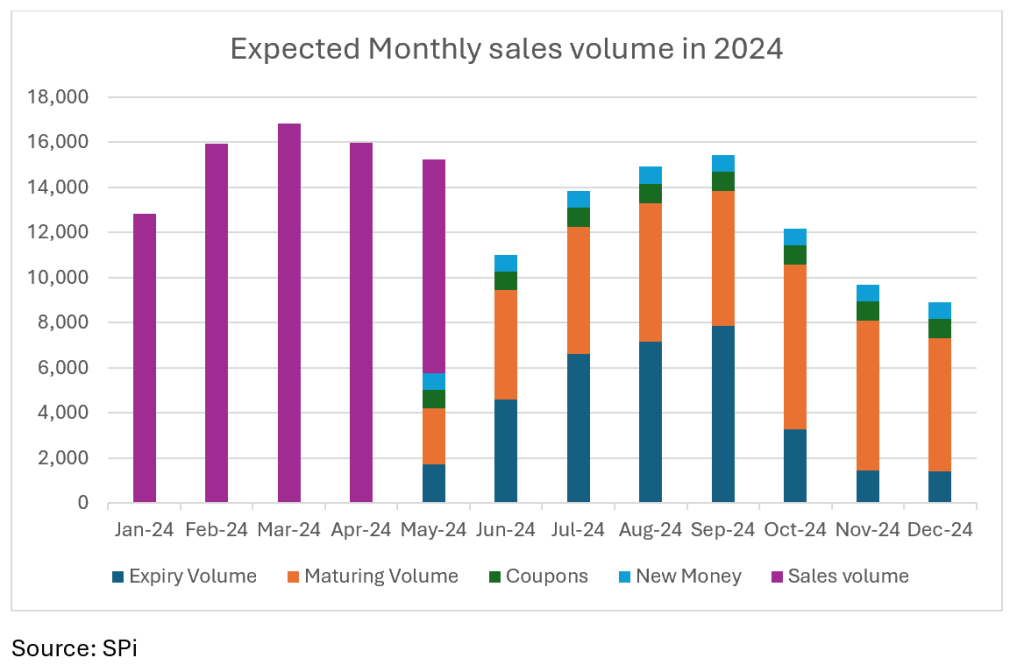

In December, we initially projected a 12.5% increase in 2024 sales if the S&P 500 reached 5,000. However, with the S&P 500 now at 5,300, our forecasts have adjusted significantly. We now anticipate a 24% rise in the US market, reaching $163 billion in sales by the end of the year, up from $132 billion in 2023.

Several key factors are driving this impressive growth. Foremost among them is a substantial increase in expiry volumes, particularly during the first four months of the year. This surge has created a dynamic market environment, with heightened activity and increased sales opportunities.

One of the primary reasons for the uptick in sales volume is the changing landscape of financial instruments and investment behaviors. As market conditions fluctuate, investors are keen to capitalize on favourable expiry volumes, leading to a notable rise in trading volumes. This behaviour was especially pronounced in the early months of 2024, where we observed significant spikes in activity especially in April.

A contributing factor for the 24% expected increase is the role of maturing volumes. As previous products reach their maturity, the proceeds are often reinvested, creating a cyclical effect that boosts overall sales volumes. This reinvestment cycle is crucial in sustaining long-term growth and providing a buffer against potential market downturns.

Coupons will also played a consistent role in supporting sales volumes. While not as dynamic as expiry or maturing volumes, the steady contribution from coupons, as almost all Income products are 30/35% above their coupon barriers, adds a layer of predictability and stability to the market. This consistent flow helps balance the more volatile elements of the sales volume equation.

Despite the overall positive outlook, there will be some fluctuations. For instance, mid-year dips in sales volumes highlight the market’s inherent volatility and the need for adaptive strategies.

Looking ahead, the combination of robust expiry volumes, continuous new money inflows, and substantial maturing volumes positions the market for sustained growth. While challenges remain, such as potential economic shifts and regulatory changes, the current trajectory suggests a strong finish to the year.

In conclusion, the US market is poised for significant growth in 2024, driven by a confluence of factors that have created a fertile environment for increased sales volumes. Investors and market participants can look forward to a dynamic year with ample opportunities for growth and expansion.

Chart of the week: